HOWARD: Yup, this really is among the many grand disadvantages to help you bankruptcy proceeding. A bankruptcy proceeding bankruptcies stick to your credit reports for 10 years, if you are Chapter 13 actually disappearing having seven much time decades. Meaning you’ll have difficulties getting home financing, an auto loan, plus a charge card – just in case you will do, predict the speed getting sky-high.

That makes sense, regardless if. Your experience an appropriate strategy to often treat otherwise help reduce money you borrowed lenders. Other lenders will take see. They will be most cautious about handing you more income.

JOYCE: Exactly what costs can’t be found in a bankruptcy proceeding?

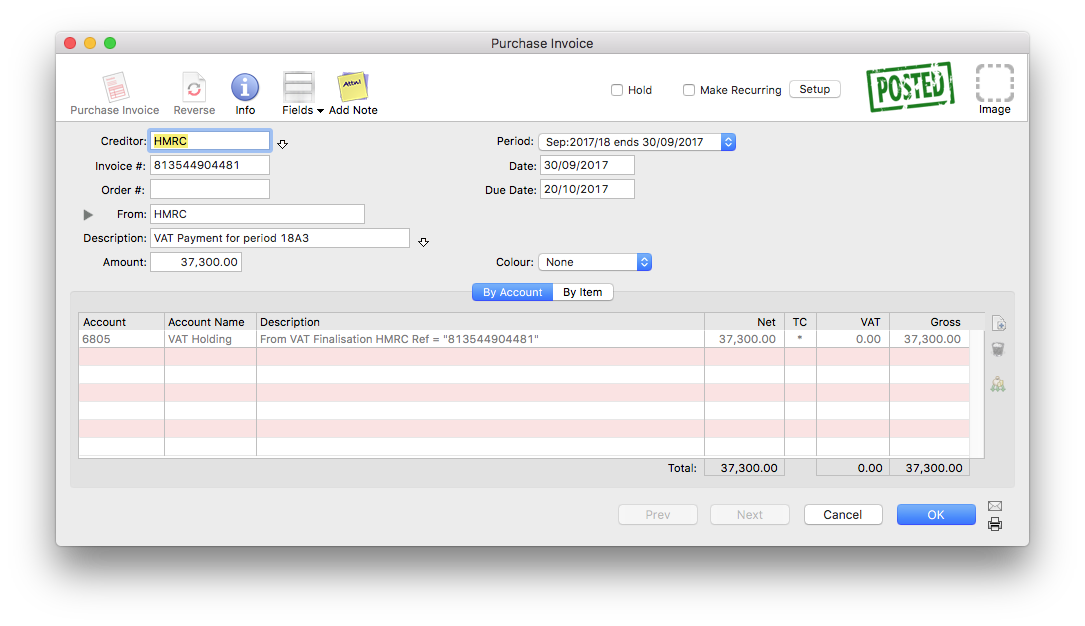

HOWARD: There are numerous, actually. The big one for most people? The average student loan burden contained in this nation is actually $37,100000 – and you will dos billion Us americans owe $100,000 or maybe more. Yet , that can’t go away in almost any types of bankruptcy proceeding. Then there’s kid help, alimony, Societal Cover taxation, taxes, straight back taxes, courtroom costs, and you may – other biggie – mortgage personal debt.

JOYCE: What’s the differences once a bankruptcy proceeding ranging from “billed out of” and you will “discharged” to your expenses listed on your credit report?

HOWARD: One is a legal identity. The other are an accounting label. “Discharged” mode you have a court acquisition, additionally the people can’t do anything to get what you owe him or her. “Charge-off” is what your own lenders propose to perform. They fundamentally state you dry on them and either write off the debt given that lost or sell it in order to a profile agencies – which will upcoming concern you to blow back one thing.

JOYCE: Think about other items influenced by your credit history, such as insurance policies? What happens in it shortly after a bankruptcy?

HOWARD: It is another usually-skipped personal bankruptcy condition. Insurance providers is won’t replace your own principles when they end. Your residence mortgage and you can auto loan will likely be on the line. Then you’ll need to find selection, being online but will set you back significantly more.

But let us describe that scary misconception: Bankruptcy proceeding does not lead to insurance companies cancelling your own rules. We have been talking about renewing those people principles once their label is actually upwards.

In the end, when you need to buy life insurance after bankruptcy, that could rating difficult, as well. Really companies want your watch for some time after your discharge. How much time depends on brand new carrier.

JOYCE: What if one style of borrowing from the bank are around for someone who provides a recently available bankruptcy?

HOWARD: You will want to reconstruct their believe on people who provide money. A protected bank card is but one great way. It’s simply an appreciation term to own a charge card that really needs an initial put. Generally, the borrowing limit are everything you deposited. Musical unusual, right? But loan providers will like your much more if one makes any payments punctually, and they’ll count it on your borrowing from the bank rehab.

The same style applies that have a cards-builder financing. In place of other fund that provides the currency initial, the financial institution puts the cash in a savings account. You will be making costs, at the conclusion the new loan’s label, you earn the cash. If you make money promptly, you help your borrowing and you may reconstruct the faith.

JOYCE: Which are the most critical something some one can do build the credit report and get right up?

HOWARD: Bankruptcy was exhausting and you can date-sipping, however, that’s where the true functions starts. You should be diligent when you’re going to blunt this new poor parts of bankruptcy proceeding. Let’s break they off…

Earliest, get into the new practice of examining your credit history to own errors. The latest Federal Change Commission has said up to one fourth off all the credit history has actually mistakes included. Just after case of bankruptcy, those  individuals mistakes could cost your. Very make sure the proper membership were discharged, and the ones discharged membership provides a zero harmony. And make sure the time of your processing is correct. How do you do one to? Simple, head to annualcreditreport. You can check your credit file throughout the Large About three credit bureaus – Equifax, Experian, and you will TransUnion – just after an excellent per year 100% free.

individuals mistakes could cost your. Very make sure the proper membership were discharged, and the ones discharged membership provides a zero harmony. And make sure the time of your processing is correct. How do you do one to? Simple, head to annualcreditreport. You can check your credit file throughout the Large About three credit bureaus – Equifax, Experian, and you will TransUnion – just after an excellent per year 100% free.